Zerodha is a prominent discount stock brokerage firm based in India. It was founded in 2010 by Nithin Kamath and Nikhil Kamath. Zerodha is known for its online trading platform, which allows investors and traders to buy and sell stocks, commodities, and other financial instruments on major stock exchanges in India, including the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Here are some key points about Zerodha

- Discount Brokerage: Zerodha is a discount brokerage firm, which means it offers lower brokerage fees compared to traditional full-service brokers. This has made it popular among cost-conscious traders and investors.

- Online Trading Platform: Zerodha provides a user-friendly online trading platform and mobile app that allows traders to execute trades, analyze market data, and manage their portfolios efficiently.

- Innovative Features: Zerodha has been innovative in introducing new features to its platform, including tools for technical analysis, charting, and algorithmic trading. They also launched initiatives like “Varsity,” an educational platform to help traders learn about the stock market.

- Demat and Trading Accounts: Zerodha offers dematerialized (Demat) and trading accounts to investors, allowing them to hold and trade securities electronically.

- Transparency: Zerodha is known for its transparency in brokerage charges. They have a flat fee structure, which means traders are charged a flat rate per trade, regardless of the trade volume.

- Customer Support: Zerodha provides customer support through various channels, including phone, email, and online chat, to assist clients with their queries and issues.

- Educational Initiatives: Zerodha has focused on educating investors and traders through initiatives like webinars, tutorials, and blogs. This educational approach aims to empower individuals to make informed investment decisions.

1. Zerodha Discount Brokerage

Zerodha is a popular discount brokerage firm in India. As a discount broker, Zerodha offers lower brokerage fees compared to traditional full-service brokers. Here are some key aspects of Zerodha’s discount brokerage model.

- No Minimum Brokerage: Zerodha does not have a minimum brokerage requirement. Many traditional brokers used to impose a minimum brokerage amount, which could be a disadvantage for small traders. With Zerodha, even small trades can be executed without worrying about meeting a minimum brokerage threshold.

- Flat Fee Structure: Zerodha charges a flat fee or a fixed brokerage rate per trade, regardless of the trade volume. This is in contrast to traditional brokers who charge a percentage of the trade value as brokerage. The flat fee model can result in significant cost savings for traders, especially those who trade in large volumes.

- Free Equity Delivery Trades: Zerodha offers commission-free equity delivery trades. This means that investors can buy and hold stocks for the long term without incurring any brokerage charges. This is a significant benefit for long-term investors.

- Low Intraday and F&O Charges: For intraday trading and trading in derivatives (Futures and Options), Zerodha charges a flat fee per trade, making it cost-effective for traders who engage in these activities frequently.

- Transparent Pricing: Zerodha is known for its transparent pricing structure. All charges and fees are clearly mentioned on their website, ensuring that traders and investors are aware of the costs involved in their transactions.

- Online Trading Platform: Zerodha provides an advanced online trading platform and a mobile app that allows traders to execute trades, analyze market data, and manage their portfolios efficiently. The user-friendly interface caters to both beginners and experienced traders.

- Educational Resources: Zerodha offers educational resources and tools to help traders and investors make informed decisions. Their initiatives, such as “Varsity,” provide educational materials and tutorials on various topics related to trading and investing.

2. Zerodha Online Trading Platform

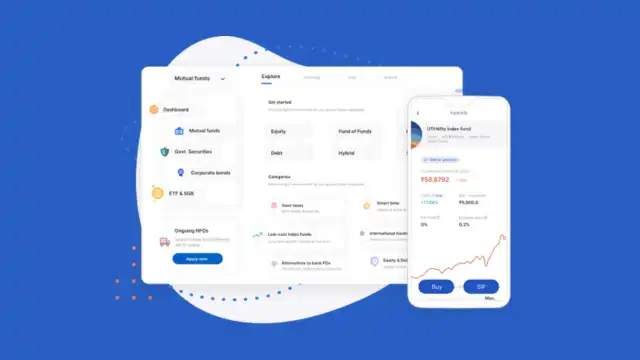

As of my last update in September 2021, Zerodha provides an advanced online trading platform and a mobile app for trading and investing in Indian stock markets. Here are the key features of Zerodha’s online trading platform.

- Kite Web: Zerodha’s flagship trading platform is called Kite. It’s a web-based trading platform accessible through a web browser. Kite offers a clean and intuitive interface, making it easy for both beginners and experienced traders to use. It provides real-time market data, advanced charting tools, and a wide range of technical indicators for technical analysis.

- Kite Mobile App: Zerodha offers a mobile trading app called Kite Mobile. The app is available for both Android and iOS devices. Kite Mobile allows traders to trade and monitor the market on the go. It provides features similar to the web platform, including real-time streaming quotes, advanced charting, and order placement capabilities.

- Charting and Analysis: Zerodha’s trading platforms offer advanced charting tools with a variety of chart types, timeframes, and technical indicators. Traders can perform in-depth technical analysis using these tools to make informed trading decisions.

- Market Watch: Traders can create customized market watchlists to track their preferred stocks, commodities, or other financial instruments. The market watch provides real-time price updates and market-depth information.

- Order Types: Zerodha’s platforms support various order types, including market orders, limit orders, stop-loss orders, and bracket orders. These order types allow traders to implement different trading strategies and manage their risk effectively.

- Fund Transfer: The platform provides a seamless fund transfer facility, allowing users to transfer funds to and from their trading accounts securely.

- Portfolio Tracking: Zerodha’s trading platforms offer portfolio tracking tools that allow investors to monitor the performance of their investments. Users can view their holdings, check their profit and loss statements, and assess their overall portfolio performance.

- Educational Resources: Zerodha’s platforms are integrated with educational resources such as “Varsity,” which provides educational materials and tutorials to help traders and investors learn about trading and investing concepts.

Table of Contents

3. Zerodha Innovative Features

Zerodha, one of India’s leading discount brokerage firms, is known for its innovative approach to trading and investing. While my knowledge is up to date only until September 2021, here are some of the innovative features that Zerodha was known for at that time:

- Kite Platform: Zerodha’s trading platform, Kite, is highly intuitive and user-friendly. It offers advanced charting tools, technical analysis, and a customizable workspace, catering to both beginners and experienced traders.

- Zerodha Varsity: Zerodha Varsity is an extensive educational platform that provides free, high-quality education on various topics related to trading, investing, and financial markets. It offers modules, chapters, and quizzes, making learning about finance interactive and accessible.

- Coin: Zerodha Coin is a platform that allows investors to invest in direct mutual funds. It enables users to buy mutual funds directly from asset management companies without paying any commissions to distributors. This can result in substantial savings for long-term investors.

- Sensibull: Sensibull, integrated with Zerodha, is an options trading platform that helps traders with strategies, modelling, and real-time trading decisions. It offers features like strategy builders, simulations, and a community for discussing trading ideas.

- Smallcase: Zerodha has integrated with Smallcase, a thematic investment platform. Smallcases are model portfolios of stocks or ETFs (Exchange-Traded Funds) centered around a particular theme or strategy. Zerodha users can invest in these small cases to diversify their portfolios.

- Streak: Streak is an algorithmic trading platform integrated with Zerodha. It enables traders to create and backtest trading algorithms without any coding knowledge. Users can deploy these algorithms in the live market through Zerodha’s trading platform.

- Console: Zerodha’s back-office platform, Console, provides users with in-depth insights into their trading and investment activities. It offers detailed reports, analytics, and statements to help users track their performance and make informed decisions.

- Pulse: Pulse is a social media platform by Zerodha that aggregates social media posts, news, and discussions related to stocks and trading. It provides traders with real-time market sentiment analysis.

4. Zerodha Demat and Trading Accounts

Zerodha offers both Demat and trading accounts to its customers. Here’s what you need to know about these accounts

- Demat Account: A Demat (short for dematerialized) account is an electronic account that holds stocks, bonds, exchange-traded funds (ETFs), mutual funds, and other securities in dematerialized or electronic form. When you buy shares, they are credited to your Demat account, and when you sell them, they are debited from the account. Zerodha provides Demat account services to its customers, allowing them to hold and manage their securities electronically.

- Trading Account: A trading account is used to place buy or sell orders for stocks, commodities, or other financial instruments in the stock market. When you want to trade, you place orders through your trading account. Zerodha offers a trading account that is integrated with its online trading platform. Through this account, you can execute trades, monitor the market, and manage your investments.

Key points about Zerodha’s Demat and trading accounts

- Integrated Services: Zerodha typically provides integrated services, meaning your trading account and Demat account are linked. This integration allows for seamless transactions between buying and selling securities and holding them electronically.

- Paperless Account Opening: Zerodha offers a paperless account opening process, allowing customers to open both Demat and trading accounts online without the need for physical paperwork. The process often involves verification of documents electronically.

- Online Access: Once your accounts are opened, you can access them online through Zerodha’s trading platform. This online access provides real-time market data, advanced charting tools, order placement capabilities, and portfolio tracking features.

- Customer Support: Zerodha typically offers customer support to assist account holders with any queries related to their Demat and trading accounts. Support may be available through various channels such as phone, email, and online chat.

- Charges: Zerodha, like other brokerage firms, may have specific charges associated with opening and maintaining a Demat and trading account. These charges can include account opening fees, annual maintenance charges (AMC) for the Demat account, and transaction charges for trades executed.

5. Zerodha Transparency

Zerodha is widely recognized for its transparency in the brokerage industry, and this transparency manifests in several ways

- Clear Fee Structure: Zerodha provides a clear and straightforward fee structure to its clients. The brokerage charges are prominently displayed on their website, detailing the charges for equity delivery, equity intraday, futures and options trading, commodity trading, and other services. This transparency ensures that traders and investors are aware of the costs associated with their trades.

- No Hidden Charges: Zerodha is known for not having hidden charges. The fees and charges that clients see on the website are typically comprehensive and cover the expenses associated with trading and maintaining accounts. This transparency helps clients plan their trading activities without unexpected costs.

- Educational Initiatives: Zerodha invests in educating its clients about the stock market and trading through initiatives like “Varsity.” By providing free educational resources, Zerodha empowers traders and investors with knowledge, enhancing their understanding of the market and trading strategies.

- Regular Communication: Zerodha communicates updates and changes transparently to its clients. This includes changes in brokerage rates, updates to the trading platform, or any other modifications in services. Clear communication helps clients stay informed and adapt their strategies accordingly.

- Account Statements: Zerodha provides detailed account statements to clients, allowing them to track their transactions, holdings, and portfolio performance. These statements offer a transparent view of their investments, enabling clients to assess their trading activities effectively.

- Support and Assistance: Zerodha’s customer support team is known for its responsiveness and helpfulness. Clients can reach out to customer support for clarifications about their accounts, transactions, or any other concerns. The support team often operates with a transparent approach, providing clients with accurate and clear information.

- Disclosures and Compliance: Zerodha adheres to regulatory requirements and ensures compliance with market regulations. The company maintains transparency in its financial disclosures and regulatory filings, instilling confidence in clients and stakeholders.

6. Zerodha Customer Support

Zerodha is known for its responsive and helpful customer support. Here are some key points regarding Zerodha’s customer support

- Channels of Communication: Zerodha offers multiple channels through which customers can reach their support team. This includes email support, telephone support, and online chat. Customers can choose the channel that is most convenient for them.

- Email Support: Customers can send detailed queries or concerns via email to Zerodha’s support team. The support team typically responds to emails promptly, addressing customer concerns in a timely manner.

- Telephone Support: Zerodha provides phone support for customers who prefer to speak directly with a support representative. They have dedicated phone lines for different types of queries, ensuring that customers are directed to the appropriate department.

- Online Chat: Zerodha offers an online chat feature on its website and trading platform. Customers can engage in real-time chat with support representatives, making it convenient for quick queries and issue resolution.

- Knowledge Base: Zerodha maintains a comprehensive knowledge base on its website. Customers can find answers to frequently asked questions (FAQs) and detailed guides on various topics related to trading, account management, and technical issues. This resource can be incredibly helpful for customers looking for self-help solutions.

- Social Media: Zerodha is active on social media platforms, including Twitter and Facebook. Customers can reach out to them through these channels for support-related queries.

- Educational Initiatives: While not directly customer support, Zerodha’s educational initiatives, such as “Varsity,” provide valuable educational resources to customers, helping them understand trading concepts and the use of Zerodha’s platform more effectively.

7. Zerodha Educational Initiatives

Zerodha is renowned for its efforts to educate traders and investors through various educational initiatives. Here are some of the key educational resources provided by Zerodha.

- Varsity: Zerodha Varsity is a comprehensive online platform offering free education on various aspects of trading and investing. It consists of modules, chapters, and quizzes that cover topics ranging from stock market basics to advanced trading strategies. Varsity is accessible to anyone, and the content is presented in a user-friendly manner, making it easy for beginners to grasp complex concepts.

- TradingQ&A: TradingQ&A is an active community forum hosted by Zerodha. Traders and investors can ask questions, share ideas, and discuss market trends. Zerodha experts and experienced community members often provide valuable insights and answers to queries, creating a supportive learning environment.

- Webinars and Workshops: Zerodha conducts webinars and workshops on various trading and investing topics. These live sessions allow participants to interact with experts, ask questions, and gain practical insights into trading strategies, market analysis, and more.

- Z-Connect Blog: Zerodha’s official blog, Z-Connect, features articles, market updates, and educational content. Traders and investors can find analyses of market trends, trading tips, and information about new features on Zerodha’s platforms.

- YouTube Channel: Zerodha maintains an active YouTube channel where they upload instructional videos, market analyses, and tutorials. These videos cover a wide range of topics, catering to both beginners and experienced traders.

- Open Trade: Open Trade is a unique initiative by Zerodha that allows traders to share their trades and trading strategies with the community. Traders can explain their rationale behind trades, fostering a collaborative learning environment where members can analyze and discuss real trading scenarios.

- Educational Events: Zerodha occasionally organizes educational events, both online and offline, where traders and investors can learn from industry experts. These events provide networking opportunities and access to valuable insights from professionals.